How can equity be transferred in an orderly way and to the right people?

The benefits of adjusting equity based on profit contribution at a law firm include the following:

- Ensuring those partners who consistently contributing profits to the firm have a commensurate influence on firm strategy, policy, and management;

- Ensuring units are available for new partners without a disproportionate impact on the productive partners;

- Facilitating the transition of firm ownership from one generation to the next; and

- Ensuring the most consistently productive partners have the votes to protect the culture of the firm.

Having a system for the ordinary transfer of ownership interests is most prevalent in mature firms. Many of the first generation law firms only change ownership percentages when a new partner is admitted or after a partner exits.

Many firms decouple ownership from compensation to help ensure fair pay. Typically, paying partners is accomplished using a bonus plan or some other formulaic approach. Inevitably, however, a firm must implement a process for the orderly transfer of law firm equity.

One of the most difficult times in a lawyer’s and law firm’s life is when a firm experiences an actual change in control. This can be especially difficult when founding partners are still practicing in the firm they helped to build and that, sometimes, bears their namesake.

Realizing the risk of partner defections and the eventual extinction of the firm, smart partners understand they must make room for others in a timely way. Ultimately, most partners want a positive legacy and do not want to be known as the person who presided over the demise of the firm.

How, then, can equity be transferred in an orderly way and to the right people?

If you have been following our other pieces and have applied these fundamentals, transferring ownership is much easier. The boxes below link to the previous articles in our competitive analysis series so you can review or catch up.

|

|

|

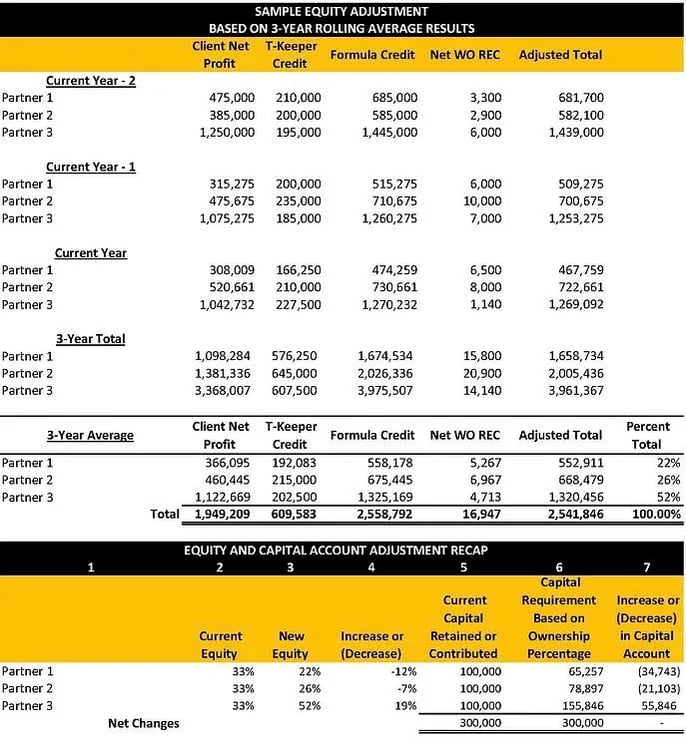

We suggest that changing units based on contributed profits over a sustained period of years. The most common period is three years, although adjusting units every two years may be necessary when law firm partner compensation is tied all or in part to equity.

There is no firm size limitation to this approach. Consider consider the following simple example of a three-partner firm using a 3-year rolling average adjustment method:

Adjusting equity using this process is very simple. Here, the indicated 3-years results for each partner are stacked and averaged. The addition of the current year, current year minus one and current year minus two are averaged and compared. The resulting percentages (percent total) are the indicated equity interests.

The final chart compares the current equity (column 2) of each partner (1/3 each in this example) and compares it to the indicated equity (column 3) based on 3-year rolling average contributed profits, which results in an increase or decrease (column 4). In this example, we assume that the partners each have an existing contributed or retained capital (undistributed earnings) balance (column 5) of $100,000.

Assuming this sample firm desires to maintain the firm’s capital balance at $300,000, column 6 indicates the new capital account requirement based on their new ownership percentage. Capital accounts are then adjusted (capital is returned to reducing partners, and additional capital is required from increasing partners) based on each partner’s existing capital balance and their post adjustment ownership percentages (column 7).

Each year this process would repeat based on the prior 3-Year rolling average of contributed profits.

|

|

![]() For more information on any of these topics or to see our prior posts, please visit our website Performlaw.com and our blog perforlaw.com/blog.

For more information on any of these topics or to see our prior posts, please visit our website Performlaw.com and our blog perforlaw.com/blog.

.webp?width=127&height=110&name=PerformLaw_Logo_Experts3%20(1).webp)